Are you searching for how much is a down payment on a house? Let us discuss it with all the factors involved. A house typically requires an initial down payment between 3% and 20% of its purchase price. Your exact down payment requirements depend on which loan program you use; government loans like VA and USDA allow for zero percent down payments while larger jumbo loans often necessitate minimum deposits of 10-13% or even 10% or more.

Zillow has surveyed how much is a down payment on a house. This data indicated that home buyers typically put down 10-19% of the final purchase price as part of a downpayment on a house, so to visualize your downpayment needs and see what home price range you can afford use our Affordability Calculator which considers factors like annual income, debt payments, loan interest rate, and loan term as well as any other relevant variables which might influence how much of a deposit you need for purchasing one.

How Much Is a Down Payment on a House?

A down payment is the cash payment made at closing towards purchasing a home, typically combined with loan funds to cover its full purchase price. Down payments are expressed as a percentage of this total cost.

For instance, a 10% down payment on a $300k home would represent making 10% down. Once purchased, the remaining balance can usually be borrowed against and paid back over time through monthly principal and interest repayment payments.

Do You Have to Put Down 20% When Purchasing a House?

While searching for how much is a down payment on a house, you may come across this question. A 20% down payment may be ideal. However, 58% of mortgage buyers in 2022 reported making down payments of less than 20% when purchasing homes.

Though not required, setting aside 20% can bring several key advantages:

- Lower monthly payments due to borrowing less overall.

- Better interest rates and loan terms.

- Conventional loans with no PMI fees.

- Stronger offers in competitive real estate markets

- More equity in the home you are buying.

Look at how much equity can be added by increasing the down payment on a $350,000 home by choosing to put 20% rather than 5% down, using a 30-year fixed-rate mortgage with an interest rate of 5%, and using 30-year amortization instead of amortization for payments of just 5% down versus 20. It could save over $700 monthly!

Minimum Down Payment For A House

After knowing how much is a down payment on a house, the next thing is what is the minimum down payment for a house. The amount needed as a down payment varies based on both the home type and loan used to buy it, but usually at least 3-5% down is expected from conventional loan customers with typical home buying experiences such as first-timers and those qualifying for programs like HomeReady/HomPossible mortgage programs.

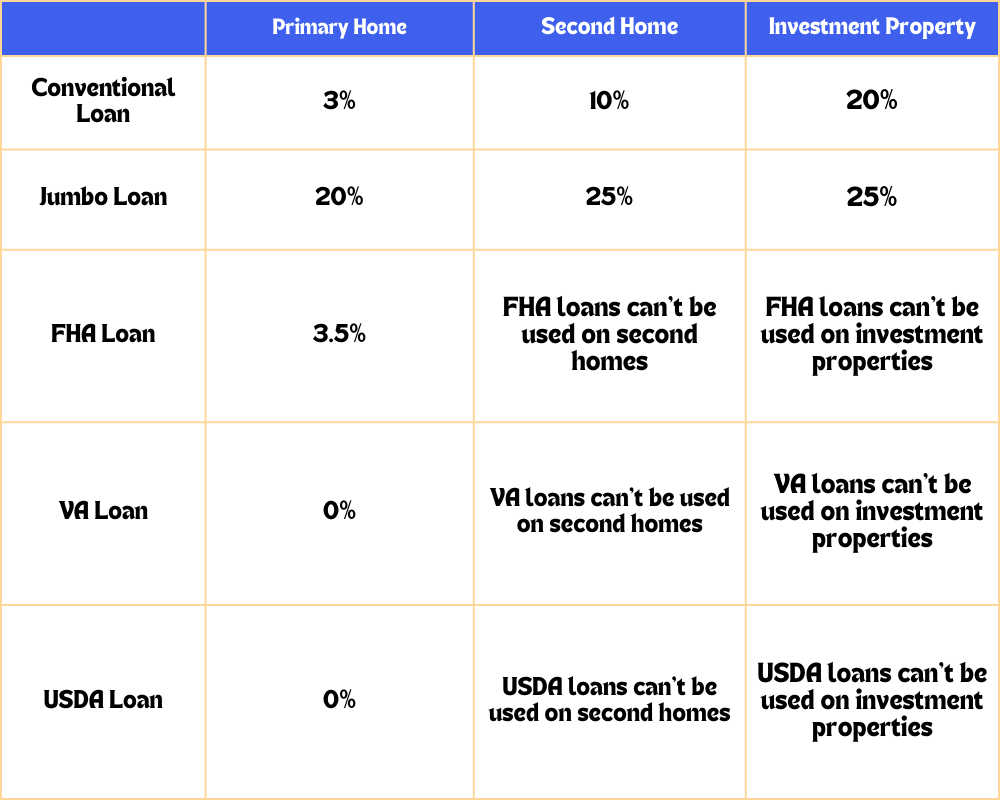

This table lists how much is a down payment on a house, or minimum down payment amounts for major loan types when purchasing either a primary residence, secondary home, or investment property. Keep in mind that requirements can differ based on location, lender type loan type credit history, etc.

How Much Down Payment Should Be Saved On a House?

While most homebuyers put down 10 – 19%, 16% in 2022 reported only making deposits between 3-5% of the final purchase price. There is no single right answer when saving for a down payment. Consider your time commitment when considering changes in housing market trends as you work toward your down payment and timeline of purchasing home ownership. While having 20% saved upfront could lower payments and save interest over time, play around with mortgage calculators until finding something suitable.

Factors To Keep In Mind While Considering How Much Is A Down Payment On A House:

Consider these factors when determining how much is a down payment on a house:

- How much cash do I need for the closing process? Depending on your upfront expenses such as closing costs, prorated taxes, and title fees. Cash may be needed as early as three to six weeks out from closing day!

- Have you allocated money towards home maintenance and upkeep expenses? To reduce ongoing homeownership expenses, set aside some savings each month for maintenance costs.

- Will Your New Home Need Repairs and Upgrades? After moving into a home, it may require repairs or enhancements that you wish to make in terms of upgrades or modifications.

- Do You Qualify for Down Payment Assistance? There may be assistance programs available that could cover some or all of your down payment costs.

How To Get A Down Payment For A House?

63% of mortgage buyers reported saving over time to meet a down payment on a house, with 46% using proceeds from selling previous residences.

Saving for a down payment takes time and discipline, yet some first-time home buyers have found success using innovative means such as taking on side gigs or setting aside tax return income every year as savings for their down payment. More traditional means include financial gifts from loved ones as well as selling stocks or investments like retirement funds or cryptocurrency to cover it all.

FAQs

Q1. How can I calculate my down payment on a $300k house using a mortgage loan?

Below are the minimum down payments required when purchasing this type of property:

- Conventional mortgage loans require at least 3% down, which would put your down payment for a $300k home at $9,000.

- FHA loans call for at least 3.5%, meaning your down payment could reach $10,500 when purchasing through this type of financing option.

- USDA and VA loans generally don’t require down payments of any sort and may even allow for the possibility of zero down payments on houses no matter their price. However, USDA loans have limits to what can be borrowed.

Buyers with lower credit scores may need to make a larger down payment; your lender can assist in considering all available options and helping make decisions accordingly.

Q2. Can You Secure a Down Payment Loan with Secured Property or Real Estate Assets (Property Vultures Loans, for example)?

Secured loans like those from personal and real property vulture lenders may be used as a down payment, unsecured loans like credit cards do not. Although once more accepted among lenders, today this method has become less commonly practiced on traditional home purchases and should usually not be done.

As loan payments will be included when calculating your debt-to-income (DTI) ratio, borrowing money to finance a down payment could affect your ability to qualify for a mortgage loan. Furthermore, secured loans require documentation in a promissory note as proof that they’ll be paid back. Nowadays home equity loans may only be used against properties bought with large down payments as an effective strategy to meet minimum down payment requirements for primary mortgages.

Q3. How Can You Buy a House without Making Any Down Payments (NDPMs)?

There are certain zero-down mortgage programs, like VA and USDA home loans, which allow a buyer to buy without making a down payment payment upfront like VA and USDA home loans. Unfortunately, these specific zero-down programs don’t cater to everyone; certain eligibility requirements need to be fulfilled depending on which loan program they wish to utilize before being accepted into them.

Down payment assistance programs (DPA) may also be available to first-time home buyers and those who haven’t owned property within three years, typically offered through state, county and city governments as grants or second mortgages with benefits such as no interest payments and deferred payments.

Q4. When do I make my down payment on a house?

Your down payment and related closing costs will be collected on the date you close on a property. Your earnest money deposit counts toward this down payment then.

Your title or closing agent is responsible for collecting and disbursing all funds during the closing process to their appropriate recipients, including paying out to sellers the total purchase price including down payments and any applicable closing costs.

Q5. Do I Require a Down Payment?

No down payment will be necessary since you already possess equity in the home and thus an equity line exists between yourself and any new lender.

If you have any more questions related to how much is a down payment on a house, contact Las Vegas Real Estate Sales now!