Are you thinking about what is an ADU, let us talk about all the important aspects of ADU you should know. Accessory dwelling units (ADUs), those separate living quarters attached or sharing land with single-family houses, are enjoying unprecedented popularity. At least 35 states and the District of Columbia, including nine including California, have altered or adopted laws making ADU construction simpler and more attractive for homeowners.

Many homeowners turn their ADUs into rental income sources or living spaces for adult children or extended family or use them as a workspace to run home-based businesses or retreats.

Still, ADU author and advocate Kol Peterson noted there could be sufficient challenges associated with building one to indicate it should only be undertaken by homeowners equipped with enough motivation, money, knowledge, and self-belief to see through this project from start to finish.

Building an ADU, said Mr. Hopper, is rewarding in many ways. The rewards can be substantial for those willing and capable of creating one.

What Is an ADU (Accessory Dwelling Unit)?

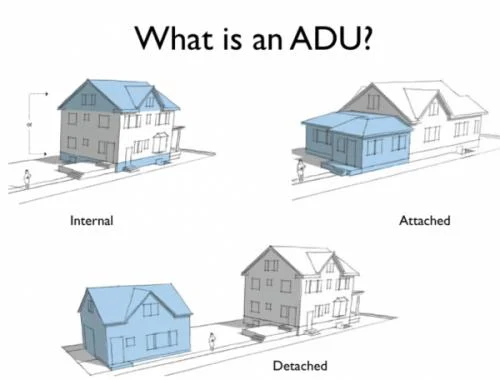

Let us discuss what is an ADU. An ADU may take one of three forms, either being:

- Newly constructed and stand-alone structure,

- Attached to your home adding living quarters as separate living space.

- Converting existing space such as a garage or basement into an independent living unit.

People often refer to ADUs by other names, including in-law apartments, granny flats, casitas, and backyard cottages. Once popular pre-World War II, many consider them more affordable sources of housing because you don’t have to buy land. Usually, the largest factor affects real estate prices, particularly in coastal cities like Seattle or LA.

Peterson teaches and writes extensively on ADUs; his blog covers this unique housing type extensively. Additionally, he’s written an encompassing guidebook “Backdoor Revolution: The Definitive Guide to ADU Development”, for those considering building one themselves.

Altering state and local laws could expedite and streamline the construction of ADUs, speeding their installation quicker.

Now after understanding what is an ADU. Are you thinking about building or acquiring an Additional Dwelling Unit (ADU) for rental income or multigenerational living?

Here are Some Key Considerations:

Can I Build One On My Property?

Before embarking on designing and planning for an ADU on your property, always first consult the city or county department that oversees planning, construction, or zoning to see whether what and where your building plans fall under their purview.

Rules regarding ADUs (accessory dwelling units) are evolving as state and local governments across the nation adopt regulations to facilitate more ADU construction to help address housing affordability concerns. California recently implemented legislation enabling people to buy or sell ADUs just like condos.

How Much Does It Cost To Build An ADU?

After knowing what is an ADU next thing is how much it costs. The cost will depend on the size, type, and local wages of an ADU being constructed. Estimates in San Jose, California one of America’s more costly cities suggest that

“a new, custom-built detached ADU may cost as much as $250,000. Retrofitting existing garage or basement may range between $80,000-$150,000 depending upon size, existing plumbing infrastructure, and desired design elements of space utilization.”

Peterson points out that construction costs, like excavation and foundation laying, make even small ADUs costly; homeowners with these fixed expenses sometimes opt to build to their maximum allowable size within their jurisdictions.

Tips to Cut Down Construction Costs

Staying away from custom-built options could help save you money, such as purchasing a manufactured home built entirely within a factory and delivered straight to your building site typically costing $86,400 for single-wide homes and $158,600 for doublewides, according to the U.S. Census Bureau estimates of average sales prices in 2022 in America alone!

Pre-built home kits or models may provide another effective means of cutting costs, provided all applicable costs, such as utility hookups, are taken into consideration. Some pre-built models only include the structure; you should consider all associated expenses like finishing out interior spaces as well as installing electricity and plumbing infrastructures before making this purchase decision.

Take advantage of pre-approved building plans offered by some county and city governments at no cost or for an annual licensing fee; they speed up the review process because they already satisfy local building codes and design guidelines.

Keep this in mind when planning to convert an existing space to separate living units. The cost is likely less. High-end finishes could add expense; using doors, cabinets, flooring, and windows salvaged from other construction or demolition projects is one way to cut expenses; check local business directories to identify salvage services near you.

How to Finance an ADU?

After knowing about what is an ADU, acquiring an ADU can be the biggest financial hurdle of all; but thanks to a new policy adopted by the Federal Housing Administration for FHA-backed loans, this process could become much simpler for some borrowers.

Under the new policy, homeowners who wish to build an ADU may apply for a rehabilitation loan known as 203(k), counting 50% of anticipated rent from that ADU as income in applying for said loan. Such an addition must either be built within or attached directly to their primary home to be considered income for this rehabilitation loan application process.

Homeowners who plan to build an attached ADU may qualify for an FHA loan by refinancing their home with 75% of anticipated rent from it; 75% counts towards qualification for this type of loan.

Peterson notes that many traditional lenders do not provide loans for ADU construction; when they do provide such financing options, however, they often require professional contractors be hired as laborers as well as higher interest rates and mortgage insurance premiums to be covered by them.

“Typically, people create an arrangement to pay for it using various means: refinancing to take advantage of home equity loans or selling investments; borrowing money from friends and family or placing part of it onto credit cards,” according to his analysis.

Some funding opportunities include:

- Existing savings

- 401K loan

- Cash-out refinancing

- Second mortgage

- Home Equity Line of Credit

- For construction loans

- Renovation loans

- Reverse mortgage

- Ground lease agreement

- Private money

- Shared appreciation or an equity agreement

- Explore alternative funds through local government or non-profits.

Who Can Build An ADU?

Before undertaking the DIY option of ADU construction, assess both your capabilities and expectations to take on such an endeavor. Though possible to act as your contractor, doing it successfully requires knowledge, time, coordination, and expertise – not something DIYers are always up for.

Development land requires careful attention to details you might overlook; such as construction permits, utility connections, and scheduling work at the appropriate cadence.

Most likely, professional services will likely handle some or all of these tasks for you:

- Design: Working with an architect and engineer, plans can be drawn up. If considering prefab or kit homes, always check with the local building department first to ensure it satisfies local codes (some cities such as Los Angeles offer pre-approved plans that you may use.)

- Construction: When hiring contractors for electrical or plumbing works, general contractors or individual subcontractors should act as conductors to oversee the entire project.

- Site Work: Water, power, sewer, and grading can all be required on any construction site. When hiring professionals for this work, get referrals from people familiar with them from people you trust before settling on any contractor or professional service provider.

For assistance on what questions to ask before hiring anyone, the Federal Trade Commission offers helpful guidelines as to what should be considered when looking at potential candidates for employment.

Recently, due to increased interest and development activity surrounding ADUs, companies have emerged that offer turnkey ADU solutions. Some offer their models, making the purchase cost less than building from scratch.

Purchasing a prefabricated or manufactured home that can be easily brought directly to your property? Before doing so, check with the city or county building department to make sure it satisfies local building code regulations. If you plan to convert an existing space into an individual dwelling unit, make sure that any contractors hired are licensed and insured.

Does An ADU Add Value To My Home?

Petersen points out that legally permitted ADUs tend to increase property value. Although ADUs won’t bring instant wealth-building opportunities, Petersen notes they can provide an effective means of building it gradually over time. Cities with high housing costs often find that rental income can quickly cover development expenses affordably and sustainably, offering homeowners future options for downsized living without needing to leave their own homes.

Some cities, like San Mateo in California, have developed ADU calculators to assist residents in assessing whether area rents will generate enough to cover monthly expenses.

Additionally,the landlord requires thoughtfulness about all its entanglements.

Pros And Cons Of ADU

After understanding what is an ADU, let us talk about the pros and cons of ADU:

Pros:

- Generate rental income

- Provide a possible place for relatives to live

- Flexibility to change with life’s stages without having to uproot

- Maximize your investment

- Help provide a home to someone else

Cons:

- Costs money to build

- Finding skilled tradespeople or manufactured builder

- Getting a handle on what’s entailed in new construction

- You have to acquire knowledge of how to be a landlord

- Loss of privacy, particularly if the ADU is attached to your primary home

Now you are aware of what is an ADU, its costs, etc. If you have any further queries contact Las Vegas Real Estate Sales now!